SES-imagotag (“the Company”) today released its unequivocal rejection of the allegations made by Gotham City (“GC”) throughout their second publication, which was designed solely to enable the short-seller to profit from any potential decline in SES-imagotag’s share price.

SES-imagotag’s document highlights how GC has deployed misleading and uninformed allegations and pre-determined conclusions that attempt to cast doubt on SES-imagotag’s governance and accounts. In contrast, in the following pages, the Company confirms that:

- The Austrian related-party agreement is contracted on an arm’s length basis and reported every year to Auditors.

- SES-imagotag’s Audit Committee is comprised of independent directors with the right mix of skills and experience to oversee the Company’s financial reporting process.

- The independent directors are indeed independent according to the strict criteria of the AFEP-MEDEF Corporate Governance code, including with their direct and indirect SES-imagotag shares ownership.

- The SESIM management holding company, which is a common vehicle used by many French listed companies, has been fully disclosed in every aspect since its inception; it advances an alignment of interest for its participants with all shareholders, as well as a genuine entrepreneurial spirit and a long-term commitment, all of which are beneficial to the Company.

- The terms of the sale of the China JV in September 2022 are aligned with SES-imagotag’s interests; the figures reported regarding this entity and this transaction are accurate and consistent with each other.

- There is no round-trip double-counting transactions between SES-imagotag and the China JV: intercompany transactions are eliminated in the Company’s consolidated financial statements.

- EBITDA figures are consistent and reconciled with consolidated financial statements, prepared under IFRS accounting standards.

- There are indeed a few typos in the English translations of the URD and Annual Report.

- The partnership with Wirecard was part of a strategy to digitize the end-to-end shopping journey. Many other large international corporations had partnerships with Wirecard at the time. The comparison with Wirecard’s accounting irregularities makes no sense.

As already communicated and given the considerable damage caused by this repeated attack, the Company has filed a complaint with the French National Financial Prosecutor[1] in particular, for disseminating false and misleading information. It has also notified the French Financial Markets Authority[2] of the numerous regulation breaches committed by Gotham City.

SES-imagotag and its teams once again thank its shareholders for their support in the face of this shameless attempt to destabilize and manipulate the Company’s share price. The Company remains fully focused on its customers, its partners, and the implementation of the Vusion ‘27 strategic plan.

- Corporate Governance

The Austrian related-party agreement is contracted on an arm’s length basis and is reported every year to auditors.

MM. Moosburger and Roessl are not part of the Board of SES-imagotag SA (in contradiction to the incorrect assertion by GC on page 11 of their second publication). They are, in fact, managing directors of SES-imagotag’s Austrian subsidiary. Therefore, the so called “undisclosed related party agreement” does not require to be disclosed in the SES-imagotag SA related-party disclosure set out in section 3 of the Annual Report. This Austrian related party agreement is reported every year to the Deloitte auditors in Austria as MM. Roessl and Moosburger are SES-imagotag GmbH (Austrian entity) directors.

MM. Moosburger and Roessl fully comply with the personal conflict of interest’s declaration according to the Group internal conflict of interest procedure. This procedure is clearly mentioned on page 115 of the 2022 URD[3] in the ESG 2022 key achievements section.

The leasing terms were carefully negotiated on an arms’ length basis and benchmarked with market prices before signature; the monthly lease price is € 12.45/m2 (€ 149/year). The same price is charged to other companies renting spaces in the building. The total annual lease is approx. € 400 K.

SES-imagotag’s audit committee chairwoman independence

GC publication states about Ms. Hélène Ploix, independent director and Chair of the Audit committee that “While having an impressive entrepreneurial track record, as well as presence on many other company’s Boards, Ploix appears to have limited experience in audit or financial reporting”.

Such statement is wrong and does not take into account Ms. Hélène Ploix deep and longstanding experience in finance-related functions, either in management roles or when sitting at the Board of directors and Audit committees of leading listed companies.

First of all, Ms. Hélène Ploix founded a private equity firm, and Chaired its investment committee. Work at a private equity firm typically involves a day-to-day review of potential investment opportunities and the monitoring of the existing portfolio, which includes going into deep details in the Company’s financial statements, budget and controlling procedures.

Ms. Hélène Ploix also undertook leading roles with financial or credit institutions, as Chair and Chief Executive Officer of Banque Industrielle et Mobilière Privée from 1982 to 1984 and director of the International Monetary Fund and the World Bank from 1986 to 1989. During the following 6 years, she served as Deputy Chief Executive Officer of Caisse des Dépôts et Consignations, in charge of the economic and financial activities and was Chair of CDC Participations, Chair of the Supervisory board of CDC Gestion and Chair of the Caisse Autonome de Refinancement.

In addition, Ms. Hélène Ploix currently is or was Chair or member of the audit committees or member of the Board of directors of companies including some of the largest French listed companies. Ms. Ploix was a member of the Board of directors of BNP Paribas, the first European bank, and a member of the Supervisory board of Publicis, a member of the French CAC 40 index. In addition, Ms. Ploix was the Chair of the Audit Committee of the Swiss company Ferring Pharmaceuticals SA, up to June 30, 2023 and has been a director and Chair of the Audit Committee of Sofina, a Belgian listed company.

The above experience of Ms. Hélène Ploix, which is fully disclosed in page 73 of the 2022 URD, clearly shows that she has “particular competences in finance, accounting or auditing”, in accordance with article L.823-19 of the French Code de commerce and is “competent in finance or accounting”, as per paragraph 17.1 of the AFEP-MEDEF Corporate Governance Code.

GC publication states that « the disclosure above claims Ploix’s “Share ownership: 0”. We find that highly misleading given that she owns shares via an unusual structure called SESIM (which we discuss further below). »

The share ownership of Ms. Hélène Ploix in SESIM (which is not an unusual structure at all, as further discussed below) is properly disclosed in the following parts of the 2022 URD:

- Paragraph 3.2.4, table showing “Summary of transactions mentioned in article L.621-18-2 of the French Monetary and Financial Code carried out during the 2022 fiscal year”, page 83 of the 2022 URD: it is mentioned in the sixth line of the table that Ms. Hélène Ploix subscribed to 154,142 shares issued by SESIM on October 13, 2022. This transaction was also disclosed in a declaration made to the French Financial Markets Authority on October 18, 2022 and published on the French Financial Markets Authority’s website on October 19, 2022, pursuant to applicable regulations.

- Paragraph 7.1.1 “Breakdown of the share capital and voting”, page 234 of the 2022 URD: it is clearly stated in a footnote to the table showing the breakdown that “SESIM is […] owned in particular by the Company’s management team and certain of its directors (Mr. Brabeck-Letmathe, Mr. Moison, Ms. Johnson, Ms. Ploix)”

GC publication states that « Ms. Ploix is listed as an “Independent” Director, but her stake in SESL shares, via the SESIM vehicle, seems to ensure that she will be conflicted, especially if SESL were to face an accounting investigation. »

As stated in sub-paragraph (iv) of paragraph 3.2.1.2 “Directors”, page 70 of the 2022 URD (which was approved by the French Financial Markets Authority on May 2, 2023 under number R.23-025), the four independent directors in office at December 31, 2022 (including Ms. Hélène Ploix) fulfill all the independence criteria stipulated by the AFEP-MEDEF Corporate Governance Code, as further set out in the table, with tick marks indicating that each of the eight independence criteria is met.

In particular, the Board of directors, upon recommendation of the ESG, Nomination and Remuneration committee, considered that criteria 8 relating to the significant shareholder status was met for Ms. Hélène Ploix. By way of reminder, the AFEP-MEDEF Corporate Governance Code stipulates that “directors representing major shareholders of the Company or its parent company may be considered as independent if these shareholders do not participate in the control of the Company. However, beyond a threshold of 10% of the share capital or voting rights, the Board, on the basis of a report by the ESG, Nomination and Remuneration Committee, systematically examines the qualification of independence, taking into account the composition of the Company’s share capital and the existence of a potential conflict of interest”.

Given the relatively limited size of the stake of Ms. Hélène Ploix in SESIM (i.e. approximately 0.5% of SESIM’s share capital), which itself only owns a minority interest in SES-imagotag at 11.97% (which translates into an indirect stake in SES-imagotag for Ms. Hélène Ploix of c. 0.06% of the share capital), it is therefore obvious that (i) Ms. Hélène Ploix does not “participate in the control of the Company” as referred to in the AFEP-MEDEF Corporate Governance code and (ii) does not cross the 10% threshold set out in the AFEP-MEDEF Corporate Governance code.

The acquisition of 5,000 shares of SES-imagotag on June 27, 2023 by Ms. Hélène Ploix (which represents c. 0.03% of SES-imagotag’s share capital and was disclosed to the French Financial Markets Authority on June 29, 2023 in accordance with applicable regulations), does not affect this conclusion. In addition, it has been noted by the Board of directors that the limited value of Ms. Hélène Ploix’s stake in SESIM and SES-imagotag compared to the value of her whole assets allows her to exercise her duties as a director of SES-imagotag regardless of any considerations linked to her financial investment in SESIM and SES-imagotag, which would affect her independence as a director.

Such an approach is followed by many French listed companies where directors hold (directly or indirectly) stakes at comparable levels. The holding of shares by directors is also a very common practice and is even encouraged by certain French organizations, such as the Association française de gestion financière (AFG), which in paragraph 2.4.7 of its recommendations on corporate governance, recommends, that “any member of the Board of directors or Supervisory board must hold a minimum (not symbolic) number of shares of the company, as long as local laws allows it”.

GC’s statements in this respect are completely incorrect, demonstrating that GC is using any and all means to discredit SES-imagotag’s governance.

It is reminded that in accordance with the recommendations of the AFEP-MEDEF Corporate Governance Code, the independence of directors is assessed on an annual basis by the Board of directors of SES-imagotag and upon renewal or appointment of any director.

Ms. Cenhui HE, director, and Mr. Franck MOISON, independent director

GC calls into question Ms. Cenhui HE’s experience and legitimacy as a member of the Audit committee, arguing that “Ms. HE may not be fluent in French and/or IFRS reporting standards. Worse, this BOE-linked member’s judgment and/or interests may conflict with SESL’s interests, given BOE’s multifaceted role as SESL shareholder/supplier/customer/creditor/etc.”.

As is the case for many French listed companies with non-French speakers sitting at their Board of directors and Board committees, the meetings of the Board and its committees are conducted in English (language in which all Board members are perfectly fluent) and all supporting materials are in English.

In addition, Ms. Cenhui HE has a strong background in finance roles, gained within the BOE group, which benefits the Audit committee. Ms. Cenhui HE has always demonstrated independent and professional judgment in her role as Audit committee member.

As BOE was the controlling shareholder of SES-imagotag until very recently, and still holds a significant stake, the presence of a director appointed by such shareholder at the Board and one of the Board’s committees is not unusual in light with the practice followed by French listed companies with controlling or significant shareholder.

It is reminded that the composition of the Audit committee is compliant, and has always complied, with the recommendations of the AFEP-MEDEF Corporate Governance Code, with at least two thirds of its members being independent directors (in the present case, Ms. Hélène Ploix and Mr. Franck Moison).

GC sees “Mr. Franck MOISON facing a similar problem as the audit committee chair, Ploix: he owns SESL shares via the SESIM structure, compromising his independence, in our view”

It is reminded that Mr. Franck Moison holds 192,678 shares of SESIM, to which he subscribed on October 13, 2022, in the context of a share capital increase of SESIM. This holding of SESIM shares by Mr. Franck Moison has been properly disclosed by the Company in paragraph 3.2.4, page 83 of the 2022 URD (seventh line). This transaction was also disclosed in a declaration made to the French Financial Markets Authority on October 18, 2022 and published on the French Financial Markets Authority’s website on October 19, 2022, pursuant to applicable regulations. In addition, Mr. Franck Moison is clearly identified as a shareholder of SESIM in paragraph 7.1.1 “Breakdown of the share capital and voting”, page 234 of the 2022 URD: “SESIM is […] owned in particular by the Company’s management team and certain of its directors (Mr. Brabeck-Letmathe, Mr. Moison, Ms. Johnson, Ms. Ploix)”.

As set out in sub-paragraph (iv) of paragraph 3.2.1.2 “Directors”, page 70 of the 2022 URD, the Board of directors considered that Mr. Franck Moison fulfills all the independence criteria stipulated by the AFEP-MEDEF Corporate Governance Code, as further set out in the table, with tick marks indicating that each of the eight independence criteria is met. In particular, the Board of directors considered that criteria 8 relating to the significant shareholder status was met.

The same reasoning as the one applying to Ms. Hélène Ploix (see above) applies here. Indeed, the limited amount of Mr. Franck Moison’s stake in SESIM (i.e. approximately 0,7% of SESIM’s share capital), which itself only owns a minority interest in SES-imagotag at 11.97% (which translates into an indirect stake in SES-imagotag for Mr. Franck Moison of c. 0,083% of the share capital), shows that (i) Mr. Franck Moison does not “participate in the control” of the Company as referred to in the AFEP-MEDEF Corporate Governance Code and (ii) does not cross the 10% threshold set out in the AFEP-MEDEF Corporate Governance Code. In addition, it has been noted by the Board of directors that the limited value of Mr. Franck Moison’s stake in SESIM compared to the value of his whole assets allows him to exercise his duties as a director of SES-imagotag regardless of any considerations linked to his financial investment in SESIM, which would affect his independence as a director.

SESIM

GC states that “In our experience as investors, we have never seen management and board members collectively hold their shares in their public company via a pooled, illiquid private vehicle.

Usually, management or board members own shares and/or transact directly in their publicly listed shares ». GC also finds “the large investment management made into SESIM surprising, compared to management’s disclosed compensation”.

SESIM (acronym for SES IMAGOTAG MANAGEMENT) is an investment vehicle in SES-imagotag shares, created in 2017 to federate SES-imagotag managers and employees who 1) already held

SES-imagotag shares – from direct market purchases, or from the sale of their start-up, or from past free shares and stock-options plans, and/or 2) wished to invest their own savings in SES-imagotag – possibly by means of a personal bank loan – through this holding company.

In this way, managers and employees have jointly created SES-imagotag’s second-largest shareholder over the years. At the end of 2022, SESIM held 11.97% of SES-imagotag, i.e. 1,897,837 SES-imagotag shares.

In order to strengthen SESIM’s position in SES-imagotag’s capital, SESIM has also opened up its capital in very minority proportions to a number of people close to the company, i.e. former shareholders of the start-ups it has acquired and a financial partner. SESIM has also taken out bank loans for this purpose.

One of SES-imagotag’s strengths lies in its strong entrepreneurial dimension, which gives management a long-term vision and creates an alignment of interests between management and shareholders.

For someone claiming “experience as investors”, GC’s statement is very surprising and raises serious questions about their professionalism and experience of capital markets.

Indeed, the use of a vehicle dedicated to the holding of the management’s stake in the company, with the management (and in some cases members of the Board) holding shares in such vehicle, is observed in many SBF 120 French listed companies. As a matter of fact, the use of such vehicle is usually seen as an efficient way of managing the management’s stake over time (in particular when the size of such stake is significant, as is the case for SESIM), especially its liquidity. Indeed, it is perceived by investors as a mean to avoid constant sales on the market by managers (if such managers were to hold shares directly), which could have a negative impact on the stock price, and allows for managers to be locked-in for a certain period of time (usually until the vehicle is liquidated, except for specific circumstances where shareholders are provided liquidity early). Generally speaking, the structuring of the management’s shareholding through this kind of vehicle commits them towards a long-term shareholding, thus ensuring an alignment of their interests with those of investors.

In this regard, GC’s vision is again completely incorrect and demonstrates their bad faith.

The management’s investment in and commitments towards the Company is one of the pillars of the Group’s strategy, allowing an alignment of interests for the benefit of all stakeholders. The Group also relies on a management team who strongly believes in the Group’s strategy and vision, and wishes to support it in the long-term. It is therefore not “surprising” that the amount invested in SESIM was significant, although invested at a time where the market cap was much lower.

SESIM borrowed to buy SESL shares on November 17, 2022

Although there is no clear grief emerging from this paragraph of GC publication, one can assume between the lines that GC blames SESIM for having financed the purchase of 240,000 shares of

SES-imagotag with a loan secured by a pledge over the SES-imagotag shares held by SESIM, as disclosed in paragraph 3.2.4 of the 2022 URD.

Implementing a secured financing for the acquisition of shares of a listed company is a usual practice allowed under French law. Again, GC’s judgment is totally disconnected from the way financial transactions are usually structured.

Absence of conflict of interest for Independent Board members

GC questions again the independence of Board members invested in SESIM, i.e. Mr. Franck Moison, Ms. Hélène Ploix, Ms. Candace Johnson and Mr. Peter Brabeck-Letmathe (holding its shares through The Glasshouse SA). GC asserts in particular that “with key independent board members highly invested in SESIM, which itself has pledged shares (for debt), independent board members of SESL that are invested in SESIM are unlikely able to make tough decisions in the interest of the common shareholder”.

We have already responded above regarding the situation of Mr. Franck Moison and Ms. Hélène Ploix and the fact that in light of their limited stake in SESIM, the Board of directors has considered that their independence is not affected by such circumstance. The same applies to Ms. Candace Johnson, who holds 19,267 shares in SESIM.

Regarding Mr. Peter Brabeck-Letmathe, his investment is made through The Glasshouse SA, both (i) directly, through the holding of 275,435 shares in SES-imagotag (i.e. 1.73% of SES-imagotag share capital), and (ii) indirectly, through the holding of 1,445,086 shares of SESIM (i.e. 4.47% of SESIM share capital, translating into a 0.53% indirect holding in SES-imagotag).

The Board of directors has assessed the independence of Mr. Peter Brabeck-Letmathe pursuant to the criteria set forth in the AFEP-MEDEF Corporate Governance Code and in light in particular of his direct and indirect shareholding in SES-imagotag. Based on the recommendation of the ESG, Nomination and Remuneration Committee (on Nov. 25, 2022), the Board of directors concluded that the limited value of Mr. Brabeck-Letmathe’s stake in SESIM and SES-imagotag compared to the value of his whole assets allows him to exercise his duties as a director of SES-imagotag regardless of any considerations linked to his financial investment in SESIM and SES-imagotag, which would affect his independence as a director. In addition, the total stake (both direct and indirect, i.e. 2.26%) of The Glasshouse SA in

SES-imagotag, although larger than the ones of the other directors, does not grant any control over SES-imagotag and remains below the 10% threshold referred to in the AFEP-MEDEF Corporate Governance Code. As a final point in this matter, the Board of directors has noted the considerable and successful experience of Mr. Brabeck-Letmathe, which brings significant added value to the work of the Board of directors, in support of the ambitious growth strategy of the Company set out in its 2027 VUSION plan.

- Joint-Venture

GC claims the following: “There’s a $10 million discrepancy between SESL and Chinese sources account of the 2019 JV investment.” “The 2019 transactions as presented by SESL do not match figures from Chinese sources”. “EUR 13.867 million is a suspiciously large use of cash for SESL in 2019”

At inception, China JV shareholders agreed to inject US$ 30mn in the China JV. The SES-imagotag prorata ownership position was 51% or US$ 15.3mn.

A first paid-in capital contribution from all the shareholders was effective in 2019 for US$ 10mn, including US$ 5.1mn (51%) for SES-imagotag.

These amounts are entirely consistent with those reported by “Chinese sources” in the column “subscribed capital contribution 15.3 million (USD)” and the column “paid in capital contribution 5.1 million (USD)”. The information is therefore fully consistent.

The Group did not make a paid-in capital contribution of US$ 15.3mn / € 13.8mn in the China JV in 2019.

The US$ 10.2mn remaining were paid later by the Group in 2020 and 2021 as agreed in the shareholder agreement.

There is no discrepancy between sources, cash balance figures reported are correct and the Group did not inject € 13.8mn cash in the China JV in 2019.

The JV’s divestiture was done on a fair valuation.

GCR claims the following: “The 2022 JV divestiture makes no sense: why dispose of a growing business for a low price?”. “In 2022, the JV’s “revenue and profits have steadily increased”

The Group already explained the reason for the China JV divestiture in the previous answer referring to GC Part I.

It is important to remind shareholders that the revenue growth from the JV was limited and the company had consistently reported losses until its disposal.

The valuation of the China JV was set US$ 10mn above the cash injected despite its cumulative losses.

It was therefore not a “low price” but a fair market value, which was confirmed by the fairness opinion issued by an external independent expert.

SES-imagotag has no relation whatsoever with the WeChat post mentioned which was published more than 5 months after SES-imagotag exited and deconsolidated the JV. The marketing-oriented WeChat message does not give any financial indication and does not reflect the performance of the Company prior to 2022.

GC claims the following: “SESL divested its 51% interest in the JV for EUR 13.867 million, the same price it originally purchased the JV”

The divestiture from the China JV was a transaction in-kind and not in cash. SES-imagotag sold its stake in the China JV but did not receive cash in return. SES-imagotag sold its stake in the China JV and received YiYun’s shares in return.

At the time of China JV’s divestiture both the valuation of YiYun and China JV were reviewed by an external independent expert which issued a fairness opinion. The valuation of the China JV was set at approx. US$ 40mn for 100% of the company, which is US$ 10mn more than the total cash injection from all the shareholders in this company (US$ 30mn). The valuation of China JV for the transaction is reported in the Note 3 to the Consolidated Financial Statements in the 2022 URD and amounts to

€ 18,668 K or approx. US$ 20.4mn (US$ 40mn x 51%). It happens to be a figure close to the one corresponding to the cash impact of the China JV deconsolidation, but this is a coincidence, and these figures are unrelated.

SES-imagotag did not sell its stake in the China JV for € 13.8mn cash. The Group received YiYun shares valued at € 18.7mn.

Note: there is a typo in the footnote to the Note 3 as the € 18.6mn refers to YiYun stake and not to the Japan entity.

GC writes the following: “At what valuation was BOE YiYun assessed at?”

At the time of the transaction, the 51% stake in China JV was exchanged for a 9.5% stake in YiYun which valued YiYun at approx. US$ 200mn.

The GC publication refers to two alternative valuations, which are not valid valuation methods of YiYun at the time of the transaction:

- The € 75mn valuation to which GC refers to is the par value of the share capital increase performed to remunerate the contribution of the China JV shares. It omits the value of the premium.

- The € 65mn in BOE books refers to a valuation in 2020 which obviously increased given the performance of YiYun between 2020 and 2022.

GC writes the following: “How much of BOE YiYun does SESL own: 9.5% or 8.9%?”

Following the transaction with SES-imagotag, YiYun made another capital increase to welcome a new investor. SES-imagotag did not subscribe to this capital increase, which therefore diluted its stake from 9.5% to 8.9% (and was made on the basis of a higher valuation of YiYun).

As of December 31, 2022, SES-imagotag’s stake in YiYun was therefore 8.9%.

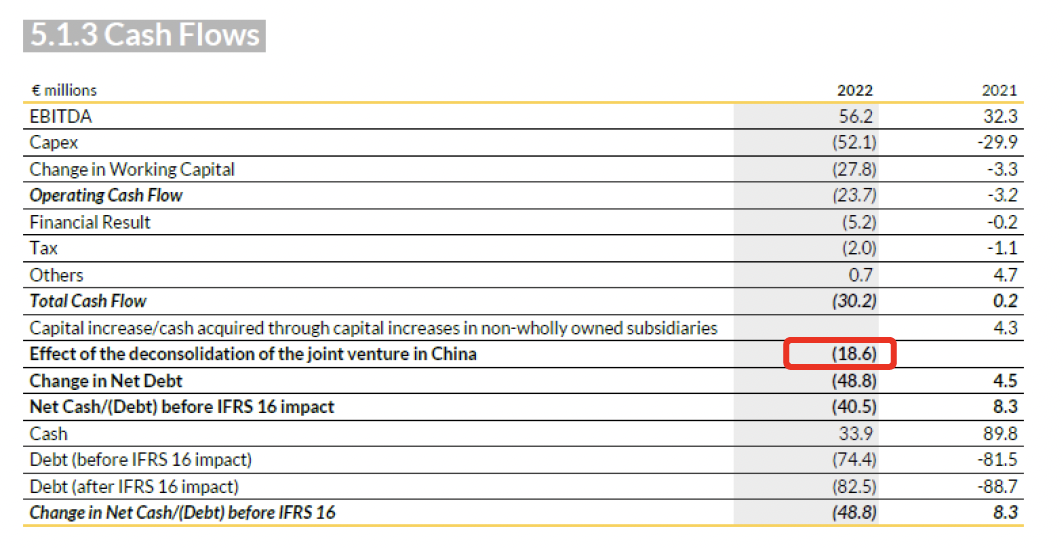

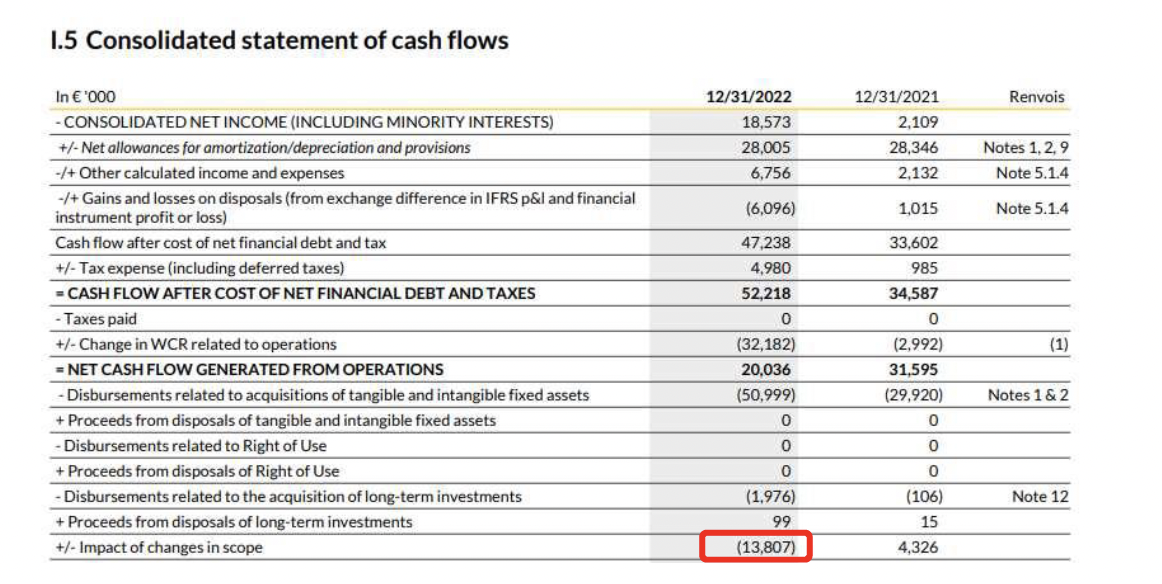

Cash impact of the JV deconsolidation

GC claims the following: “We are unable to reconcile the JV’s available cash as presented by SESL in its 2022 AR.” “EUR 13.8 million in cash [at deconsolidation time is] not credible.”

At the end of Q3 2022, when the Group deconsolidated the China JV, the balance sheet of this legal entity showed a working capital and a cash position amounting respectively to € 4.8mn and € 13.8mn. The impact disclosed in the section 5.1.3 of the 2022 URD is the addition of these 2 figures totaling

€ 18.6mn.

The € 13.8mn cash position is reported in the Consolidated statement of cash flows as shown below:

It is reminded that this € 13.8mn amount does not correspond to the selling price of the 51% stake in the JV China. It is the amount of cash on the balance sheet of the China JV when the Group deconsolidated this entity. It is indeed an impact of change in scope.

It is reminded that this € 13.8mn amount does not correspond to the selling price of the 51% stake in the JV China. It is the amount of cash on the balance sheet of the China JV when the Group deconsolidated this entity. It is indeed an impact of change in scope.

It also happens to be nearly the same amount as the initial investment of SES-imagotag (i.e. 51% of US$ 30mn = US$ 15.3mn = € 13.9mn) but it is pure coincidence, and these two figures are unrelated.

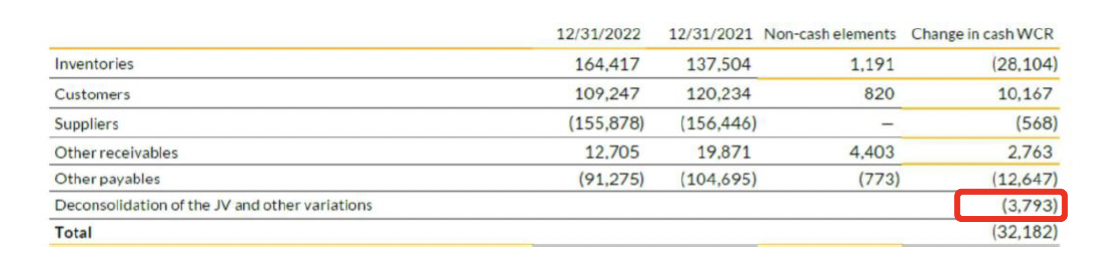

The € 4.8mn impact from the change in working capital is included in the line “Deconsolidation of the JV and other variations”. The € 3.8mn reported on this line in the note consists of € 4.8mn working capital position from the JV account and € -1.0mn from “other variations”.

The scope of consolidation impact of the deconsolidation of the China JV was therefore in the cash flow statements.

Additionally, GC considers the cash balance at the time of deconsolidation should have been higher.

Their statement is based on the calculation they made as reported in Appendix to their Part II publication:

GC considers that cash flows equal net income. The firm made the same mistake in Part I of their publication, omitting the € 4.8mn working capital impact in the case of the China JV.

GC claims the following: “We are unable to reconcile how the Group generated a capital gain in the consolidated financial statements of EUR 6.7 million:

– SESL acquired its JV stake for EUR 13.867 million in 2019 and disposed of its JV stake for EUR 13.867 million. It’s unclear what the capital gain here is.

– If by ‘capital gain’ SESL is referring to the difference in the price it disposed of its JV stake for (EUR 13.867 million) and the price it acquired its stake in BOE YiYun for (EUR 18.669 million), that difference is EUR 4.8 million, not EUR 6.7 million.”

As already stated, the Group did not dispose of its stake in the China JV for € 13.8mn.

In a transaction in-kind the selling price equals the value of the shares received in exchange of the disposal (in this case € 18.668mn).

There is only one way to define and calculate a capital gain: it equals the difference between the selling price and the value of the divested company in the books of the seller. When it is measured in the local statutory financial statements of the selling company, the difference is made between the selling price and the value of the divested company in the local statutory financial statements. When it is measured in the consolidated financial statements of the Group, the difference is made between the selling price and the value of the divested company in the consolidated financial statements of the Group.

In the stand-alone parent company’s statutory financial statement, GC correctly calculated the capital gain (€ 4.8mn), but in the consolidated financial statements, they failed to understand that the capital gain was higher.

The capital gain in the consolidated financial statements also factors in the cumulated results of the company divested over the period when it was consolidated. This explains why the capital gain in the Group’s consolidated financial statements is higher than the capital gain in the stand-alone parent company’s statutory financial statement. The cumulated losses were already apprehended in the P&L of the Group year after year from 2019 to Q3-2022.

The capital gain resulting from the disposal of the 51% stake in the China JV amounts to € 6.7mn in the consolidated financial statements.

- BOE / Chongqing

GC claims the following: “EUR 3.9 million in payments from SESL to JV: are these round-trip revenue?”

All inter-company transactions between SES-imagotag and JV are eliminated in the Group’s consolidated financial statements.

One of the roles of the Joint-Venture has been to identify cost-down opportunities by sourcing some components from Chinese local suppliers (example: e-paper display modules makers). Therefore,

SES-imagotag has purchased some components from the Joint-Venture. As all inter-company transactions, they are eliminated in the consolidated accounts and are by no means round-trip revenues.

The Chongqing exclusivity agreement was in the interest of SES-imagotag.

The artificially fabricated controversy around the exclusivity contract reflects GC’s lack of understanding of SES-imagotag’s supply chain strategy.

As part of its industrial partnership with SES-imagotag, BOE had invested in highly automated production lines. SES-imagotag wanted to retain the exclusive benefit of these production lines for a minimum period of time.

At the same time, SES-imagotag has continued its multi-sourcing strategy, already widely explained to the market, and has developed partnerships with other high-performing EMS (Electronic Manufacturing Services), in Vietnam and later in Mexico.

Therefore, the contradiction suggested between these different pillars of SES-imagotag’s successful supply chain strategy is totally false.

The Chongqing exclusivity agreement has not incurred additional debt.

GC claims the following: “SESL was severely cash-strapped and could not afford to pay without incurring debt.”

As stated in the Annual Report, the payment of the exclusivity agreement was fully completed in 2020.

There was no additional debt increase because of this payment.

According to the IFRS 16 accounting standards, the exclusivity contract has to be accounted for as a financial leasing and disclosed in the financial statements as “leasing related debts”. This reflects only the application of the IFRS16 accounting standard, but it has no impact on cash transactions. Therefore, SES-imagotag still reports it as a leasing contract in the 2022 financial accounts according to IFRS16 application.

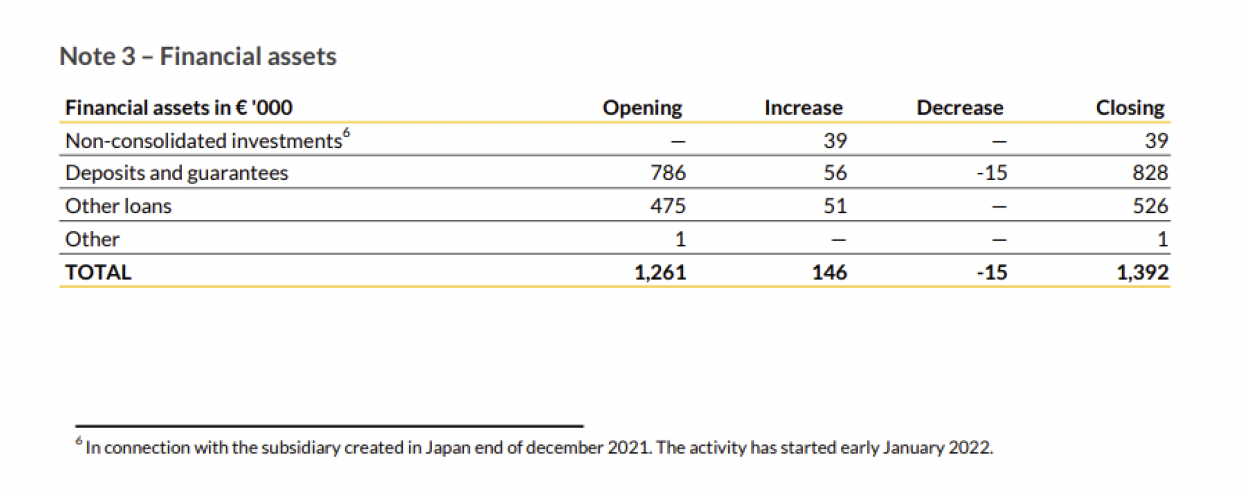

SES-imagotag Japan K.K was incorporated in 2022 with a capital subscription of € 39,000.

The Japanese subsidiary was incorporated on January 05th, 2022. To this end, SES-imagotag paid the capital of € 39,000 on December 27th, 2021. Consequently, the investment was published in the 2021 Annual Report as an increase of financial assets, with the following footnote: “In connection with the subsidiary created in Japan end of December 2021. The activity has started early January 2022”.

In the 2022 URD, there is a typo in the footnote 6 below the note 3 related to financial assets. The amount of € 18,668,000 is related to YiYun investment and not Japan’s subsidiary investment.

- Other allegations

Deferred revenue and accounts receivable

In the French Annual Report, the amount of trade receivable is € 109,247 thousand, the amount of deferred revenue is € 10,249 thousand and the amount of other debts and accrual accounts is € 91,275 thousand. The financial statements in the Annual Report are correct. There was a typo in the footnote 5 and a typo in the footnote 14 in the English translation of the report.

Value-added services

The figure reported in the Note 15 to the consolidated income statement is € 15mn higher than the Value-added services figure in the Management Report (section 5.1 of the Annual Report) due to the Fixings revenues which are not considered as VAS.

2021 goods and services revenues

The Group first reported in 2022 on the revenue split between goods and services. The 2021 goods revenue figure in the 2022 URD is lower than the figure disclosed in the 2021 URD as it refers to a different scope.

2022 EBITDA reconciliation: IFRS 16

The cash flow statement disclosed in the section 5.1.3 as management report on financial results, is based on the financial statement before taking IFRS 16 into account. The reconciliation table between the financial operation result and the EBITDA includes IFRS 16. Therefore, there is no inconsistency but a different scope of analysis.

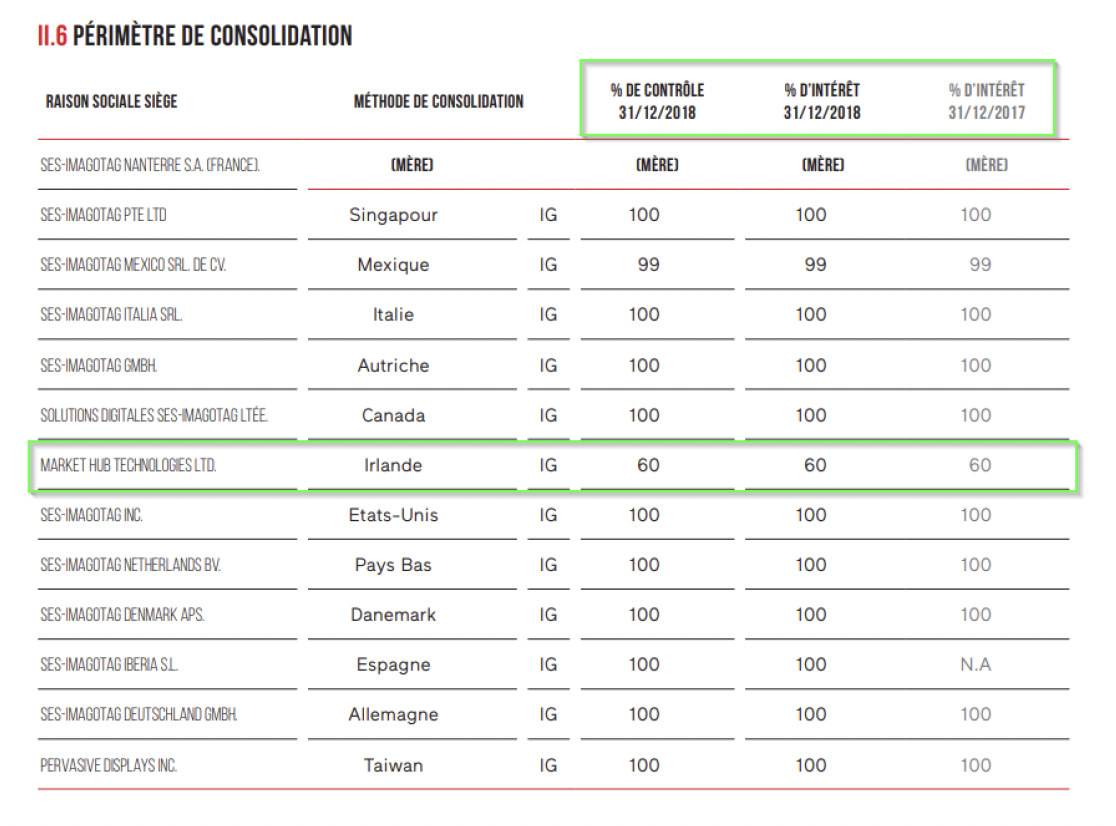

Market Hub ownership stake history

The percentage controlled in 2018 is 60%. This information has been disclosed in the French v Annual Report. There is a typo in the English translation.

Employee figures on the website

The employee figures as of May 2023 differ from the figures at year end 2022 since the periods considered are not the same. In May, employee figures include the addition of the two acquisitions made by SES-imagotag in 2023, i.e. In the Memory and Belive.ai.

Breakdown of COGS

The consolidated income statement format under IFRS is standardized and the Group is reporting under this format in its consolidated financial statements as shown in section I.2 of the URD.

A business presentation is made in section 5.1 which shows the variable cost margin.

Annual Reports available on website

Since 2006, all French Annual Reports are available on the website. The English translations were published in 2016 for the first time. They are available to all shareholders upon simple request to the company.

2019 Statement of Cash Flows

There is a typo in the statement of cash flows in the English translation. The line “opening cash position” should be named “Impact of changes in foreign currency exchange rates” and the line “closing cash position” should be named “Change in cash flow”.

R&D investments

The total amount of R&D and IT investments in 2022 is € 44.2 mn of which € 8 mn for IT expenditures and € 36 mn of R&D expenditures, as displayed in section 5.1.2 in the French Annual Report. There is a typo in the English translation.

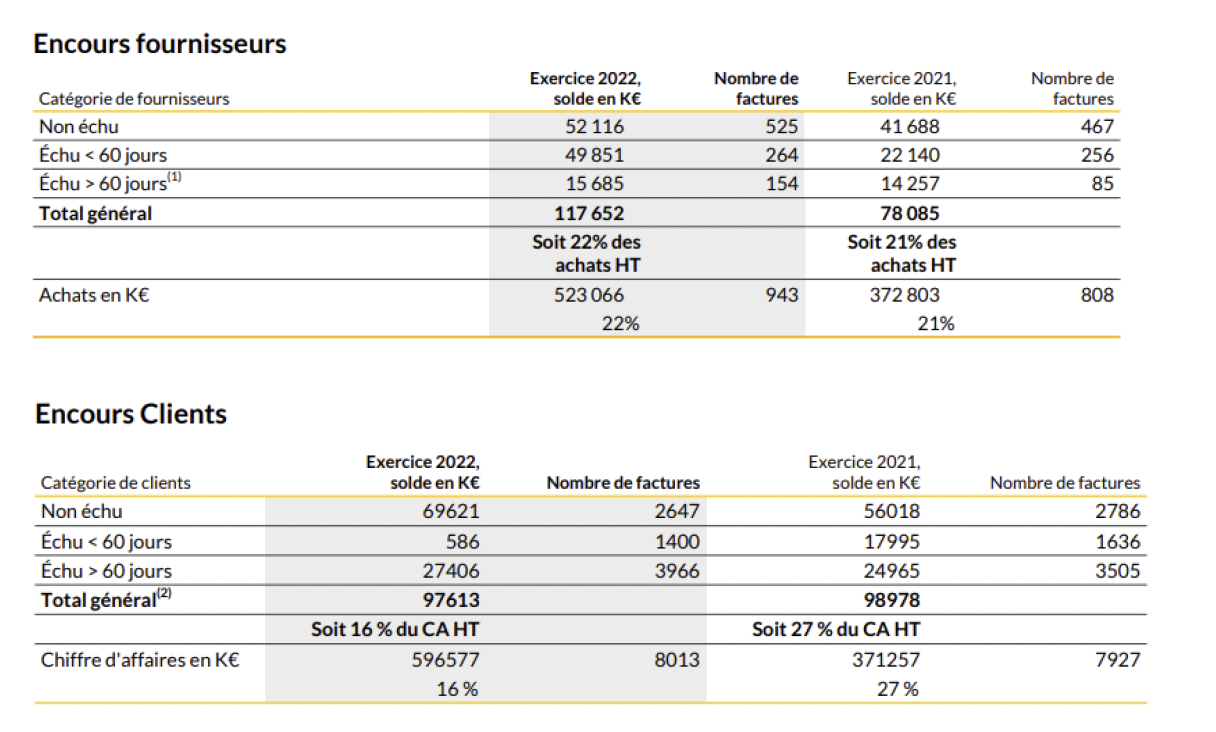

Payment terms: suppliers and customers:

The accounts payables and receivables by aging balance are the following:

There is a typo in the English translation of the Annual Report.

EUR vs USD typos in the English translation of the Annual Reports

In the English translation of the Annual Report, there were typos. The amounts disclosed in the French Annual Report are consistent with the financial statements.

SES-imagotag confirms the following amounts:

- Sales with Chongqing BOE Smart Electronic System Co. Ltd for 2022 is US$ 53.1 mn

- Framework delivery & quality assurance agreement for 2022 is US$ 3.209 mn

- Framework delivery & quality assurance agreement for 2021 is US$ 0.338 mn

- Supply service agreement for electronic labels for 2022 is US$ 33 K

- Supply service agreement for electronic labels for 2021 is US$ 83 K

Wirecard partnership

In 2018, SES-imagotag initiated a partnership with Wirecard, as both companies had several customers and partners in common. Its purpose was to create new digital services in stores, based on SES-imagotag’s NFC-enabled electronic shelf labels and Wirecard’s mobile payment technologies, which were used at the time by many well-established companies and retailers worldwide. As partners, both companies attended some marketing events. Many other very large international corporations were partners of Wirecard at that time.

Investor Relations contact:

Labrador – Raquel Lizarraga / +33 (0)6 46 71 55 20 / [email protected]

Europe:

Publicis Consultants

Audrey Malmenayde / +33 6 76 93 11 45 / [email protected]

Louis Silvestre / +33 6 24 31 06 76 / [email protected]

International:

Kekst CNC

Jeremy Fielding / [email protected]

Nick Capuano / [email protected]

Arnaud Salla / [email protected]

Disclaimer

Certain information included in this press release does not constitute historical data but constitutes forward-looking statements. These forward-looking statements are based on current beliefs, expectations and assumptions, including, without limitation, assumptions regarding the Company’s present and future business strategies and the economic environment in which the Company operates. They involve known and unknown risks, uncertainties and other factors, which may cause actual performance and results to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include those discussed and identified in Chapter 2 “Risk Factors” in the Universal Registration Document approved by the French Financial Markets Authority (AMF) and available on the Company’s website (www.ses-imagotag.com) and the AMF’s website (www.amf-france.org). These forward-looking information and statements are no guarantee of future performance.

[1] Parquet National Financier

[2] Autorité des Marchés Financiers

[3] Universal Registration Document (URD) approved by the French Financial Markets Authority on 2 May 2023 under number R.23-025